Check out their newly launched version….lots of information that you might find useful.

Category: Life Cover

A ‘right to be forgotten’ in insurance policies

THE GOVERNMENT IS planning to legislate to prevent insurance companies from using cancer survivors’ medical history against them.

A ‘right to be forgotten’ in insurance policies has been called for by cancer survivors, their families and campaigners for years, who have long argued that it is unfair for insurance companies to take cancer diagnoses into account years after a person has entered remission.

In 2023, Insurance Ireland announced a new code of practice that outlined that insurers should disregard cancer diagnoses where treatment had ended more than seven years before an application.

The Irish Cancer Society said at the time that the move was an important first step but that the government needed to step in to create legislation on the matter.

“Uninsurable because of a genetic test”: a qualitative study of consumer views about the use of genetic test results in Australian life insurance

Genetic testing can provide valuable information to mitigate personal disease risk, but the use of genetic results in life insurance underwriting is known to deter many consumers from pursuing genetic testing.

Many countries have restricted the use of genetic test results to assess individuals for risk-rated insurance products. Canada adopted the Genetic Non-Discrimination Act (GNA) in 2017, which prohibits the use of genetic information in services including insurance, with no exceptions or financial limits.

Participants stated a strong preference for government regulation to ensure adequate protection against Genetic Discrimination in life insurance and provide certainty to individuals considering genetic testing. The Australian Government is now considering its policy response to its public consultation into the use of genetic results in life insurance underwriting.

Small Study: Results show low trust in the life insurance industry’s self-regulation, and strong support for legislation from the Australian Government. Even after the introduction of the moratorium, these consumers remained concerned about the implications of their genetic test results on life insurance, and these concerns affected decision-making about genetic testing. Participants also showed little knowledge of the moratorium, or were concerned about others not being informed about it.

Irish cancer survivors need

Cancer survivors should have legal protection to ensure they are not discriminated against when it comes to financial products such as life insurance, an international conference has heard.

Last December, Insurance Ireland said a new voluntary code of practice would see insurers disregard a cancer diagnosis where treatment ended more than seven years before an application for products such as life, mortgage protection or income protection policies.

Where an applicant was under 18 at the time their cancer treatment stopped, the right to be forgotten will apply after five years.

Cover of up to €500,000 per applicant is to be allowed under the revised code, a ceiling that Insurance Ireland says covers more than 90pc of mortgage protection policies issued in the State.

However, it is still not underpinned by legislation. A spokesperson for the Department of Finance said the right to be forgotten aims to ensure equal access to financial services for individuals who have recovered from a previous illness.

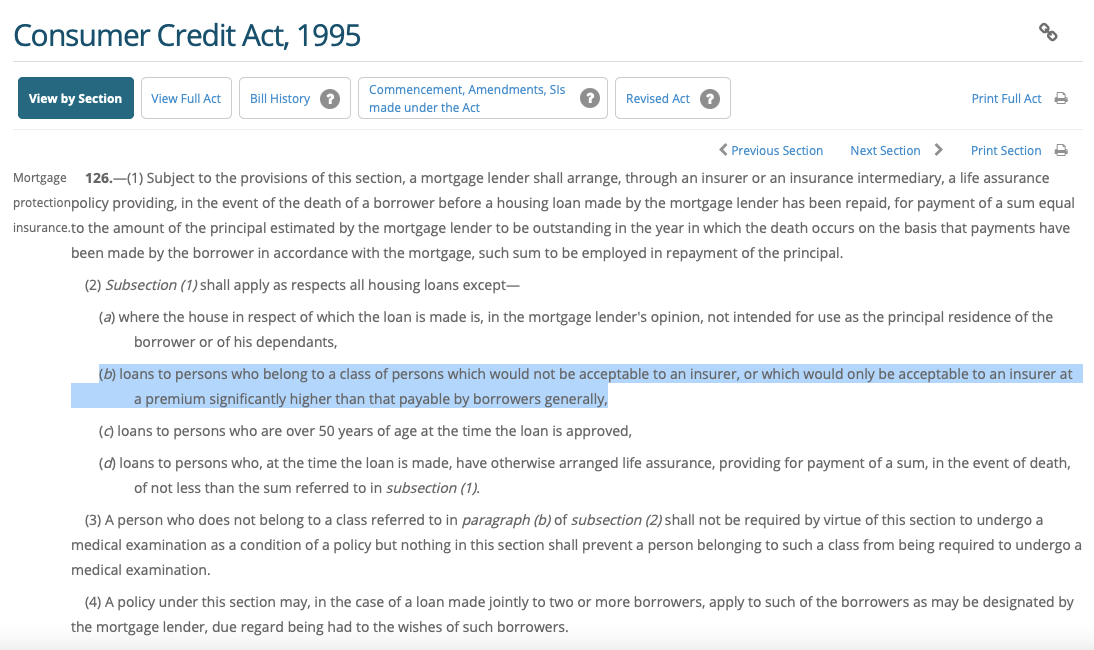

Mortgage Protection Insurance

Consumer Credit Act 1995